Insurance company ratings explained

Last updated on December 26, 2022

What do insurance company ratings mean?

Insurance company financial strength ratings represent the opinions of rating agencies regarding the ability of an insurance company to pay their obligations under the insurance policies and contracts they have issued, in accordance with their terms.

Why are insurance company ratings important?

Because long term care claims are likely to occur many years in the future, it’s important to select a long term care insurer that will be able to pay when that time comes. This translates into selecting well-capitalized (ample financial reserves) and highly-rated (assessed by ratings agencies to have strong long-term financial outlooks) companies.

Ratings agencies

A.M. Best Company assigns ratings from A++ to S based on a company’s financial strength and ability to meet obligations to contract holders.

http://www.ambest.com

Fitch assigns ratings from AAA to C based on a company’s financial strength.

http://fitchratings.com

Moody’s Investor Service (Moody’s) assigns ratings from Aaa to C based on a company’s financial security.

http://moodys.com

Standard & Poor’s assigns ratings from AAA to SD or D based on a company’s financial security.

http://www.standardandpoors.com

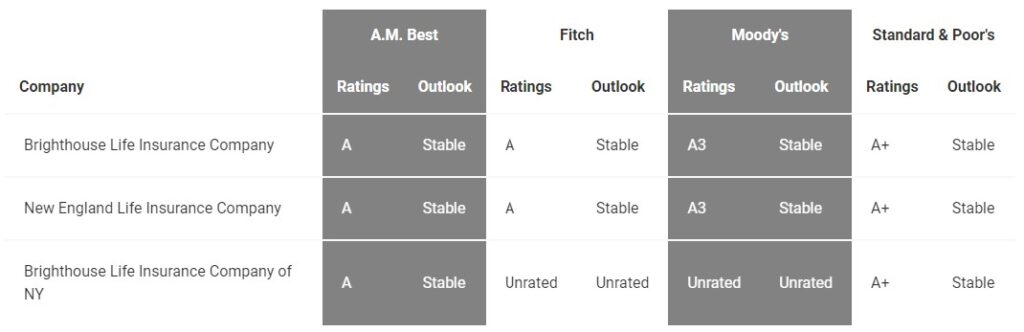

Sample ratings

Below you can find the ratings chart for Brighthouse Financial, a large provider of hybrid long term care policies. The ratings, taken together with an insurer’s financial information, as disclosed in their 10-K annual filing, allows customers to understand the overall strength & stability of their insurance company.

Compare your long term care insurance options

Are you looking for the best long term care coverage at the lowest cost, that fits your specific needs?

Our brokerage is family-run with a combined 41 years of experience in the insurance industry. As independent brokers, we offer customized advice and recommendations, and can direct you to the best option among the many carriers we represent: Brighthouse Financial, OneAmerica, Mutual of Omaha, National Guardian Life, Lincoln Financial Group and Securian.

It will be our pleasure to help you navigate your options.

For comparative long term care quotes, please contact us at 1-866-LTC-BROKERS. Or simply fill out our quote request form and we will reply shortly.

Thank you. We look forward to assisting you.

Toll-free: 1-866-LTC-BROKERS

Call today for your FREE long term care insurance quotes. Or fill out the secure form below to receive your quotes online.

🔒 We take your privacy seriously. Your information will not be shared with 3rd parties.

Leave a Reply